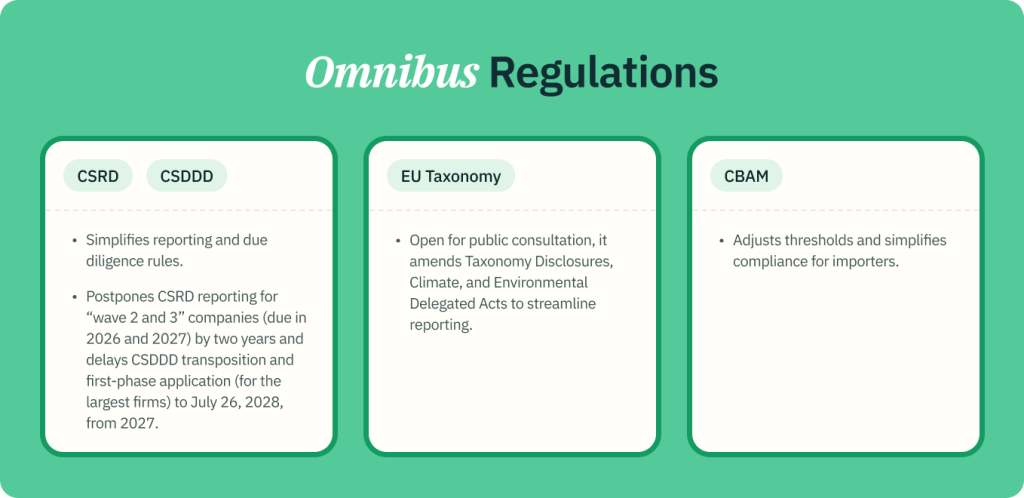

On February 26, 2025, the European Commission introduced its Sustainability Omnibus Package—a bold proposal to streamline key Green Deal regulations, including the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), the Carbon Border Adjustment Mechanism (CBAM), and the EU Taxonomy. This move aims to lighten the regulatory load on businesses striving for sustainability while preserving the EU’s ambitious climate goals. These are not final rules yet; they mark the starting point of a legislative journey through EU institutions, with approval still pending from the European Parliament and Council. Though the outcomes remain uncertain, companies in India, the US, Europe, and beyond can start preparing for potential shifts in how they report emissions and sustainability performance. At Sprih, we’re here to unpack these proposals and help you get ahead of the curve.

The EU Omnibus Directive comes from the EU’s Competitiveness Compass, launched in January 2025 by President Ursula von der Leyen. It builds on the 2024 Draghi Report’s call to strengthen EU economic prosperity. The goal? Create a business-friendly environment by cutting administrative burdens—25% for large companies and 35% for SMEs. The Commission aims to boost growth, quality jobs, and investment for a sustainable economy.

The Commission’s 2023 call for evidence and the Draghi Report exposed a major issue: complex sustainability rules were hurting EU businesses. Today’s EU Omnibus, part of a broader Clean Industrial Deal, simplifies regulations to cut costs and achieve policy goals efficiently. Announced in the Commission’s February 11, 2025 work programme, this first “Omnibus” package reforms sustainability and investment rules. It directly responds to stakeholder demands for pragmatism and simplicity.

The latest CSRD revisions significantly reduce reporting burdens, narrowing the scope to large companies with over 1,000 employees and postponing deadlines for SMEs. Key changes include voluntary standards for smaller firms, simplified reporting, and the removal of sector-specific requirements, cutting compliance costs by billions while maintaining double materiality principles

The CSRD now applies only to large companies with over 1,000 employees and either €50 million turnover or €25 million in balance sheet. This adjustment reduces covered companies by 80%, aligning CSRD with CSDDD thresholds. Smaller firms no longer face mandatory reporting.

Reporting deadlines for large companies (wave 2) and listed SMEs (wave 3) are postponed by two years. This delay allows businesses to adapt and gives legislators time to finalize changes.

Companies with up to 1,000 employees no longer fall under mandatory CSRD rules. The Commission will introduce voluntary reporting through a delegated act based on the VSME by EFRAG. This “value chain cap” prevents larger firms and financial institutions from imposing excessive data demands.

The ESRS will undergo major revisions. The Commission will cut data points, clarify vague provisions, and improve alignment with EU laws. These changes reduce complexity and lower reporting costs.

The proposal removes sector-specific reporting rules and eliminates the Commission’s authority to create tailored requirements. This change ensures a uniform, less burdensome approach across industries.

The option to increase assurance levels from limited to reasonable has been dropped. This keeps compliance simpler and more predictable.

Companies must still report sustainability risks, business opportunities, and their impacts on people and the environment.

These CSRD revisions will save businesses substantial costs. Changes to the CSRD scope and ESRS modifications could reduce annual administrative costs by €4.4 billion. Narrowed CSRD requirements alone will cut €0.8 billion in yearly Taxonomy reporting costs. Additionally, exempted companies will avoid one-time expenses for reporting and assurance, estimated at €1.6 billion for CSRD and ESRS compliance, plus €0.9 billion for Taxonomy-related efforts.

Read more on the changes in CSRD brought by the Omnibus proposal.

The latest CSRD revisions significantly reduce reporting burdens, narrowing the scope to large companies with over 1,000 employees and postponing deadlines for SMEs. Key changes include voluntary standards for smaller firms, simplified reporting, and the removal of sector-specific requirements, cutting compliance costs by billions while maintaining double materiality principles.

Companies get an extra year to prepare for the new due diligence framework. The transposition deadline shifts from July 26, 2026, to July 26, 2027. The first application phase, covering about 6,000 EU and 900 non-EU companies, now starts on July 26, 2028. To ease this transition, the Commission will release guidelines by July 2026. Businesses can then rely on best practices instead of costly legal or advisory services.

Companies no longer need to conduct full due diligence across complex value chains. They must assess indirect partners only when credible evidence suggests potential human rights or environmental risks. This shift reduces unnecessary checks on indirect partners.

Several measures cut complexity and costs for large companies.

The impact on smaller firms is limited. Large companies can only request information from SME and small mid-cap partners (up to 500 employees) at the Voluntary Standard for SMEs (VSME) level. Additional data is allowed only when essential for impact mapping and unavailable elsewhere.

The EU Omnibus Directive removes harmonized civil liability conditions, leaving national laws in control. Member States no longer need to allow trade unions or NGOs to file representative actions. Local laws will determine whether national liability rules override third-country regulations.

Climate mitigation transition plans now align with CSRD requirements. This change ensures consistency across due diligence and reporting obligations.

More due diligence provisions now follow maximum harmonization. This change levels the playing field across the EU and reduces inconsistencies in implementation.

The review clause considering financial services in the CSDDD’s scope is removed. This change confirms that financial services remain excluded for now.

These adjustments simplify the due diligence framework and improve consistency. Estimated annual savings reach €320 million, with additional one-time cost reductions. By focusing on direct suppliers, easing periodic reviews, and protecting smaller partners, the CSDDD balances accountability and practicality.

Get a more in-depth analysis here.

For companies within the future CSRD scope—large firms with over 1,000 employees—those with a net turnover up to €450 million can now opt into Taxonomy reporting voluntarily. This reduces the number of businesses mandated to disclose their Taxonomy alignment, easing compliance pressures.

Companies making strides toward sustainability but not fully meeting Taxonomy criteria can voluntarily report their partial alignment. This option highlights their efforts and progress, offering recognition for their commitment. To ensure consistency, the Commission will develop delegated acts standardizing the content and presentation of this reporting.

Draft amendments to the Taxonomy Disclosures, Climate, and Environmental Delegated Acts introduce major simplifications:

The Commission is seeking stakeholder input via public consultation on two alternative options to streamline the complex “Do No Significant Harm” (DNSH) criteria for pollution prevention and control, particularly related to chemical use and presence. These criteria apply across all economic sectors under the Taxonomy, and the proposed simplifications aim to make compliance more manageable, with feedback invited on both approaches.

Read more about EU Taxonomy and the changes that are expected with the EU Omnibus proposal.

Benefits: These updates ease administrative loads, especially for smaller players, while upholding nearly full emission coverage.

Understand the implications of the EU Omnibus proposal on CBAM.

Benefits: These simplifications save €350 million for partners and recipients while driving growth with the €50 billion infusion.

The EU Omnibus Directive promises €6.3 billion in annual administrative cost savings and €50 billion in additional investment capacity. Here’s the breakdown:

The EU Omnibus Directive doesn’t waver from the Green Deal’s goals. As von der Leyen emphasized, “sustainability and competitiveness should go hand in hand.” By addressing stakeholder concerns—overly complex rules, high costs, and limited investor utility—the package makes sustainability pragmatic, driving investment and jobs while advancing the EU’s climate agenda.

At Sprih, we specialize in turning regulatory complexity into actionable solutions. Here’s how we support companies in India, the US, and Europe:

The EU Omnibus Directive is a work in progress—subject to European Parliament and Council negotiations. Its final shape will emerge over 2025. For now, proactive adaptation is key.

Sprih stands ready to guide you through this shift. Whether you’re measuring emissions, reporting sustainability, or optimizing your supply chain, we’re your partner in thriving under the EU Omnibus. Get in touch with Sprih’s experts to explore how these changes impact your business—and how we can help you succeed.